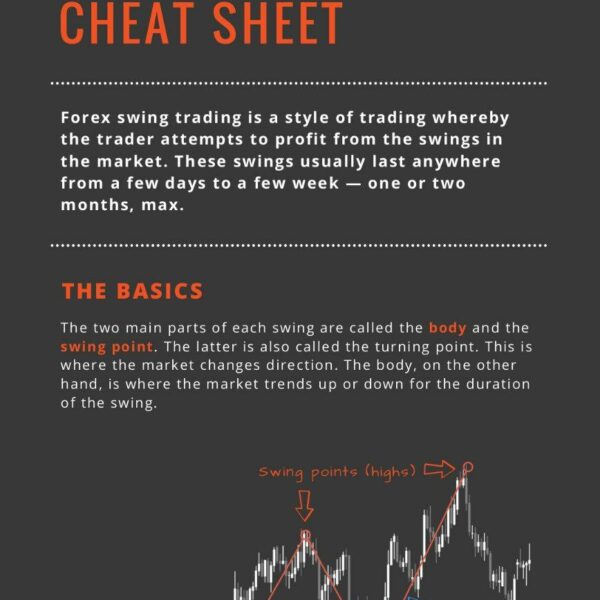

Swing Trading Cheat Sheet: A Comprehensive Guide

Introduction

Swing trading is a popular strategy that aims to capitalize on short- to medium-term price movements. Traders seek to capture swings within an established trend, making it suitable for various markets, including forex and crypto. In this guide, we’ll delve into the key aspects of swing trading and provide actionable insights for successful trades.

Minimum Deposit

Before diving into swing trading, ensure you have an adequate capital base. While the minimum deposit can vary across brokers and markets, consider starting with at least $1,000. A larger account allows for better risk management and flexibility in executing trades.

Optimal Time Frame

Swing trading thrives on the daily time frame. Here’s why:

- Daily Candles: The daily chart provides a balanced view of price action, filtering out noise and capturing significant trends.

- Sufficient Data: Daily candles offer enough data points for reliable analysis without overwhelming traders.

- Less Stress: Unlike intraday time frames, swing trading on the daily chart reduces stress and allows for better decision-making.

Currency Pairs

Choose currency pairs that exhibit clear trends and liquidity. Here are some popular pairs for swing trading:

- EUR/USD: The Euro-US Dollar pair is highly liquid and often displays well-defined swings.

- GBP/JPY: The British Pound-Japanese Yen pair offers substantial volatility, ideal for swing trading.

- AUD/USD: The Australian Dollar-US Dollar pair provides consistent trends and manageable spreads.

Swing Trading Strategy

Now, let’s discuss the strategy behind swing trading:

- Identify Key Support and Resistance Levels:

- Draw horizontal support and resistance lines on your daily chart.

- Use trend lines to identify dynamic levels.

- Evaluate Momentum:

- Confirm the prevailing trend using indicators like moving averages or the Relative Strength Index (RSI).

- Look for alignment between price and momentum.

- Watch for Price Action Signals:

- Wait for candlestick patterns (e.g., bullish engulfing, hammer, or doji) near support or resistance.

- These signals indicate potential reversals or continuations.

- Set Profit Targets and Stop Loss Levels:

- Define clear profit targets based on recent swing highs or lows.

- Set stop losses just beyond key support or resistance levels.

- Calculate and Manage Risk:

- Determine position size based on risk percentage (e.g., risking 1-2% of your account per trade).

- Adjust position size as your account grows or shrinks.

Disclaimer: Trading involves risks, and past performance is not indicative of future results. Always conduct thorough research and seek professional advice before trading.📈🍀

Stay Updated:

Instant Download: https://mahakaryadigital.com/product/swing-trading-cheat-sheet-final/

Contact: https://mahakaryadigital.com